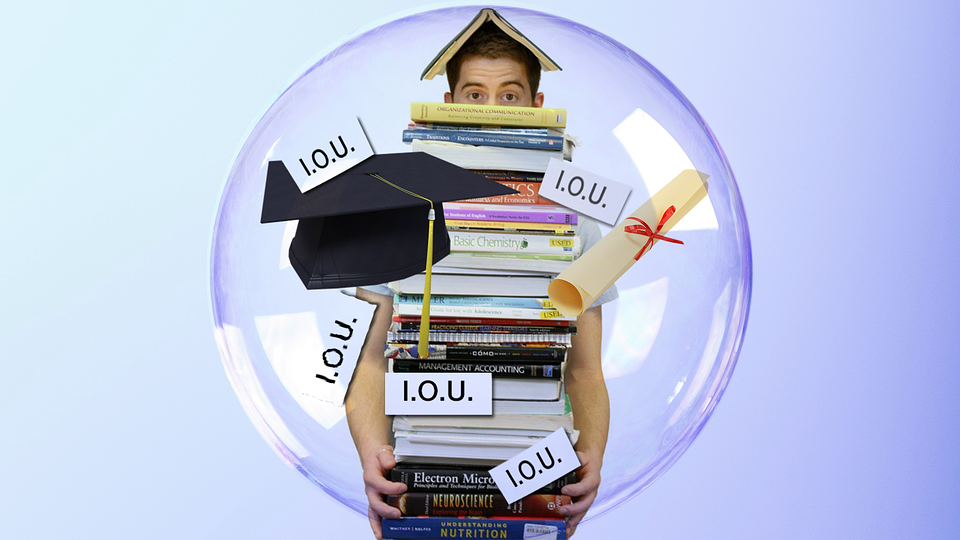

Four years ago, student loan debt in America topped $1 trillion. Today, that number has swelled even further, with some 43 million Americans feeling the enduring gravity of $1.3 trillion in student loan debt.

While student debt may not intuitively register as something that plagues the poor, student debt delinquency and defaults are concentrated in low-income areas, even though lower-income borrowers also tend to have much smaller debts. Defaults and delinquencies among low-income Americans escalated following the Great Recession of 2008, a period when many states disinvested from public colleges and universities. The result was higher costs of college, which has led to larger loans.

Low-income students are often left at a dramatic academic disadvantage in the first place. For example, students who work full-time on top of college classes can’t cover the cost of tuition or living expenses, and working while in school can actually shrink the chance of graduating altogether. Moreover, these students are less likely to have access to career counseling or outside financial resources to help them pay for school, making the payoff negligible at best.

The inequity is so crushing that an alarming number of these students—predominantly students of color—are dropping out of school altogether. One-third of low-income student borrowers at public four-year schools drop out, a rate 10 percent higher than the rest of student borrowers overall.

Read the full story here.