By Charlene Crowell

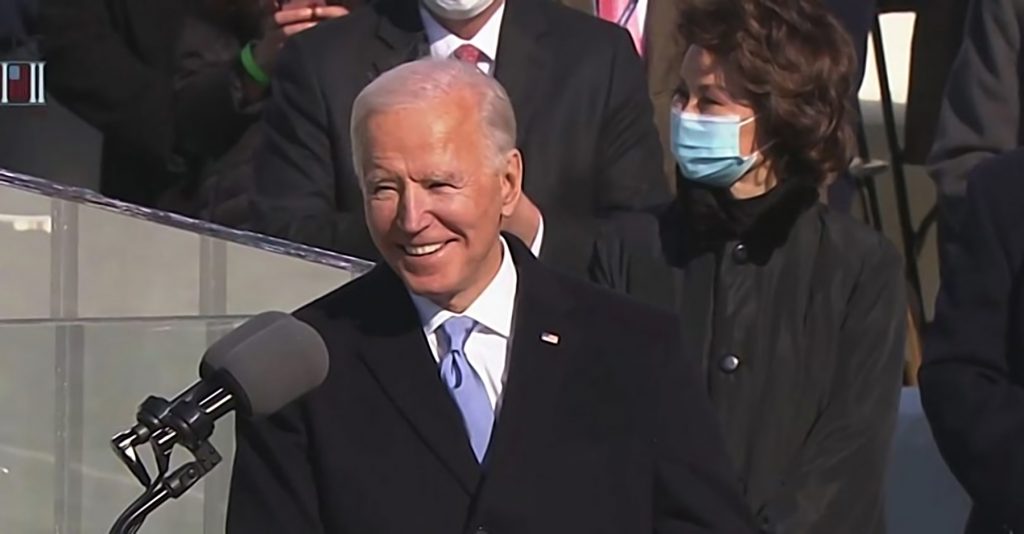

As President Joe Biden begins his term of office, the nation and much of the world are waiting and watching to see how his promises become policies and practices that relieve long-term and widespread suffering.

In his January 20 inaugural speech, President Biden said, “The American story is about the slow, yet steady widening of opportunity…Make no mistake: Too many dreams have been deferred for too long. We must make the promise of the country real for everybody — no matter their race, their ethnicity, their faith, their identity, or their disability.”

The 2021 inaugural also made history as former California Senator Kamala Harris took the oath to serve the nation as its Vice-President. No woman has ever served in this key role, nor has an HBCU graduate.

Yet in the aftermath of an administration that will likely be recorded as the worst in American history, a suffering nation is anxious for promises to become policies and programs that provide overdue relief.

Following his inauguration, President Biden signed a series of executive orders, many of which repealed a range of issues from his predecessor. For example, on the international front, the 46th President ended the Muslim travel ban, rejoined two global efforts – the Paris Agreement on Climate Change and the World Health Organization. Other executive orders focused on domestic issues like ending the border wall construction and extending the current pause on student debt payments and interest, as well as moratoriums on evictions and foreclosures.

NDG 1/14: Disavowing Black and Brown Votes: Just say ‘no more, not ever again’ and push back at corporations that support rogue Republican politicians

Still, many advocates raised their voices in pushing the Biden Administration to do even more.

“It’s not enough to have an election and put new people into office,” Rev. Dr. William Barber II, co-chair of the Poor People’s Campaign recently told the New York Times. “We must push and continue to push for the kind of public policy that really establishes justice.”

A still-ravaging pandemic that has taken more than 400,000 American lives is intertwined with an economic recession that added 1.15 million workers to the ranks of the unemployed in the first week of 2021, according to the Department of Labor. These updated unemployment figures also revealed that Black and Latina women have been hit hardest by unemployment. This increase adds even more financial stress to the more than seven million people who in the last week of December continued to rely on unemployment insurance.

NDG 1/7: ‘We Took the Capitol’: Trump supporters storm the chambers of Congress

“We applaud the extension of the eviction, foreclosure and student loans moratoriums, the institution of a 100 day mask mandate, and the rejoining of the World Health Organization, and are ready to work with President Biden, Vice President Harris, and our Senate partners to build on these measures with the swift passage of a comprehensive and bold relief package that meets the scale of this crisis,” said Washington Congresswoman Pramila Jayapal, chair of the Congressional Progressive Caucus. “We have no time to waste.”

. Scores of other advocates are focusing on ways to provide immediate relief in several ways.

For example, student debt now totaling $1.7 trillion affects more than 44 million borrowers of varying ages. The combination of the pandemic with a recession have together worsened the ability of borrowers to manage loan repayments.

More than 325 organizations, including the Center for Responsible Lending (CRL), called upon the Biden administration to use its executive authority to cancel federal student debt on its first day. Originally sent this past November, the letter was updated on January 15 with 85 additional signers.

NDG 12/24: Biden nominations broaden Black women’s leadership roles

In part, the letter advises, “The disproportionate impact of student debt on borrowers of color exacerbates existing systemic inequities and widens the racial wealth gap. Black Americans—and particularly Black women—are more likely to take on student loan debt and struggle with repayment. This burden is particularly acute for those Black students who are targeted by for-profit institutions, which also target veterans and often deliver poor instructional quality and outcomes at a high cost, causing a high proportion of students to drop out.”

It is important to acknowledge that President Biden has called on Congress to cancel $10,000 of federal student loan debt per borrower and included reforming income-based repayment and loan forgiveness for borrowers in public service jobs in his higher education plans. However, these actions will help only some – not all — of the borrowers now holding federal loan debt.

“Cancellation will help jumpstart spending, create jobs, and add to the Gross Domestic Product (GDP)”, said Ashley Harrington, federal advocacy director and senior counsel at CRL. “Short-term payment suspension alone is not enough to help struggling borrowers who are unemployed, already in default, or in serious delinquency.”

Curbing widespread and abusive debt collection practices in the first 100 days is another issue that should be an early priority. This $11 billion industry thrives on taking profits from financially distressed consumers, affecting an estimated 71 million consumers each year.

Long before the pandemic and its accompanying recession, debt collection complaints consistently topped the list of consumer concerns at the Federal Trade Commission and Consumer Financial Protection Bureau (CFPB). Although laws like the Federal Debt Collection Practices Act set guidelines for debt collectors, the lack of enforcement during the Trump years effectively green lit financial abuses in both lending and collection.

Payday loan regulation, promulgated by CFPB’s first director, was rescinded during the Trump Administration. And in many ways this agency acted as an opponent of regulation, aiding businesses despite being created to serve as consumers’ financial watchdog.

Consumers duped by unscrupulous lenders and creditors could no longer count on CFPB to hold bad actors accountable and make consumers financially whole.

President Biden has announced that he will appoint Rohit Chopra as the agency’s new CFPB Director and Kathryn Kraninger, the Trump-appointed CFPB Director, resigned on January 20th.

Consumer advocates are encouraged that this important financial regulatory body will return to its original and vigorous efforts – to protect consumers across a wide range of lending. Previously, and under the agency’s first director, Chopra served as its Assistant Director, focusing on student loans. Since the spring of 2018, he has served as a Federal Trade Commissioner.

Reactions to a newly-proposed CFPB Director were swift and positive.

Lisa Rice, President and CEO of the National Fair Housing Alliance (NFHA), stated, “Unlike CFPB directors selected by Donald Trump, Mr. Chopra will steadfastly adhere to the agency’s founding mission of protecting consumers and effectively providing oversight of the country’s financial sector.”

“I am confident that Mr. Chopra will not only return the CFPB to its central mission – protecting consumers – but also ensure the agency plays a leading role in combatting racial inequities in our financial system,” said U.S. Senator Sherrod Brown of Ohio. Brown is expected to chair the U.S. Senate Committee on Banking, Housing, and Urban Affairs, which will convene confirmation hearings for this position.

Similarly, another federal regulatory body, the Office of the Comptroller of the Currency (OCC), also promulgated rules during the Trump administration that supported banks taking a major role in payday lending. The OCC’s actions had substantially contributed to the predatory lending that led to the foreclosure crisis, and ultimately to the Great Recession, including the draining of a trillion dollars in wealth from communities of color.

On December 18, a friend of the court – or amicus – brief was filed to challenge OCC’s rule that protected banks from state laws banning usury. Organizations joining the brief were: CRL; National Consumer Law Center; East Bay Community Law Center; National Association for Latino Community Asset Builders; and National Coalition for Asian Pacific Americans Community Development.

In part, the brief states, “Today, the rent-a-bank scheme is making a comeback. Primarily through installment loans, lenders are charging up to 274% APR in states that do not permit those rates.”

Now, while a new President begins the considerable task of righting what went wrong by his predecessor, it is crucial for those who believe in equality, fairness, and justice to stand up and speak out.

“All Americans deserve ladders of opportunity to create and sustain economic prosperity—not just a select few,” noted Mike Calhoun, CRL President. “We look forward to continuing to work with the Biden-Harris team on these and many other challenges.”

As National Youth Poet Laureate Amanda Gorman so poignantly stated in her inauguration poem, The Hill We Climb, “The new dawn balloons as we free it. For there is always light, if only we’re brave enough to see it. If only we’re brave enough to be it.”

Charlene Crowell is a Senior Fellow with the Center for Responsible Lending. She can be reached at Charlene.crowell@responsiblelending.org.