Never-married Black women have 8 cents in wealth for every dollar held by while males

By Charlene Crowell

As the November general election nears, many economic analysts have publicly pondered why so many likely voters are not impressed with reports that point to more hiring, or economic growth. But if these experts spoke with hard-working Americans, they’d understand why so many are disgruntled.

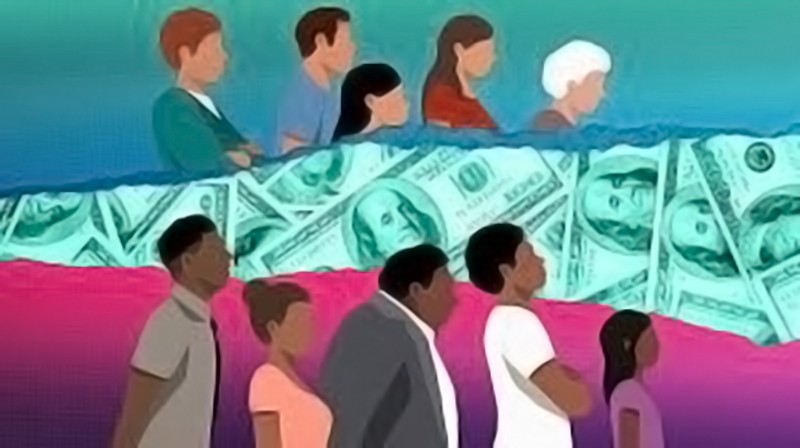

A wealth of new research spells out stark wealth and income disparities that reflect a far different economic dynamic: people who work full-time, but find it difficult to get ahead financially. Race and ethnicity remain nagging factors. But emerging gender and occupational trends play a large role as well.

A late March update of the St. Louis Federal Reserve Bank’s ongoing research on wealth inequalities offers several eye-opening data points:

• Overall, women had only 68 cents in wealth for every dollar held by their male peers;

• When data was filtered by race/ethnicity, never-married Black women and never-married Hispanic women had 8 cents and 14 cents, respectively, of the wealth of white males;

• Never-married Black women, never-married Hispanic women and never-married mothers of any race or ethnicity were the most financially stressed. They had very low levels of wealth to fall back on in an emergency, or to invest in financial stability and mobility; and

• Each of the never-married groups is in the bottom third of the wealth distribution for U.S. households.

But low racial and gender wealth is inextricably tied to income.

An Institute for Women’s Policy Research (IWPR) report highlighted the inequities in full-time workers’ pay.

“Equal pay for equal work has been the law of the land for more than a half-century, yet women still cannot get fair treatment when it comes to employment and earnings,” noted Jamila K. Taylor, IWPR President and CEO. “And it’s worse for women of color, who face rampant racial discrimination in the workforce in addition to ongoing pay inequities.”

The report, The 2023 Weekly Wage Gap by Race, Ethnicity and Occupation, explores how these three factors are intertwined. In 2023 overall, according to IWPR, the wage gap for full-time workers by gender improved, but when race and ethnicity were factored into the analysis, a substantial wage gap grew.

The median income of white men in 2023 increased more than all other groups, but IWPR found substantial wage gaps for Latinas and Black women. Weekly median wages for Black women dropped to 65.8 percent in 2023, down from the previous year’s 67.4 percent. Similarly, Latina wages fell from 2022’s 61.4 percent to 59.2 percent in 2023.

The highest paying occupations – management, business, and finance positions – brought white men a median weekly income of $1,905, according to IWPR. But these same occupations paid Black men $1,488, and Black women earned even less at $1,287 per week.

By comparison, service occupations – paying less than other occupations such as sales, construction, and transportation – paid median full-time weekly wages of $917 to white men, and $749 to Black men. Black women and Latinas earned even less in these occupations, with Black women taking home median weekly wages of $654, and Latinas earning $646.

Even compared to workers of the same race or ethnicity women continued to earn less as full-time workers. For every dollar a Black man earned Black women earned 91.6 cents. Latinas earned even less, earning 87.4 cents for every dollar earned by a Latino man.

“Tackling profound gender and racial wage gaps requires a variety of policies,” states the IWPR report. “These include addressing discrimination in all aspects of employment and tackling occupational segregation and its consequences, both by improving women’s access to and retention in well-paid jobs predominantly held by men and by improving earnings and job quality in undervalued jobs predominantly held by women.”

A report from the Urban Institute, How Policymakers Can Close the Wealth Gap for Black Women asserts that any serious proposals to eliminate lingering and widespread barriers to wealth building must address the monthly costs that deny the ability to save money: lower women’s wages, child care costs, student loan payments, and unaffordable health care.

“Policies that help Black women afford rent, child care, education, and food would allow them to pursue higher-paying employment opportunities and increase their ability to afford basic expenses, save, and invest in assets,” states the Urban Institute report.

To remedy these historic inequities, the Urban Institute calls for policymakers to:

• Make college more affordable;

• Ensure pay equity and support for women entrepreneurs;

– Expand access to caregiving services and affordable health care; and

• Make mortgages more accessible.

Charlene Crowell is a senior fellow with the Center for Responsible Lending. She can be reached at Charlene.crowell@responsiblelending.org.